Help Tips: Daily Bank Reconciliation

The monthly reconciliation of the firm's cash balance to the bank statement may become tedious if transactions are mis-keyed or missed altogether.

The situation is easily rectified by the daily monitoring of the transactions posted by the bank via the bank's online website.

Transactions, such as checks, may be correctly posted in LAWS/Pro but may not clear the bank for days, or even weeks.

Other transactions - such as debit card purchases - could clear the bank but may never have been entered in LAWS/Pro.

Daily reconciliation of the firm's cash balance to the bank takes just minutes per day and immediately uncovers errors or omissions.

It also reveals any fraudulent activity allowing it to be addressed and rectified in a timely manner.

To start the process, make sure the cash balance has reconciled to the bank statement balance as of the prior months end.

Each morning thereafter log onto your online banking program to review the current bank balance and recent activity.

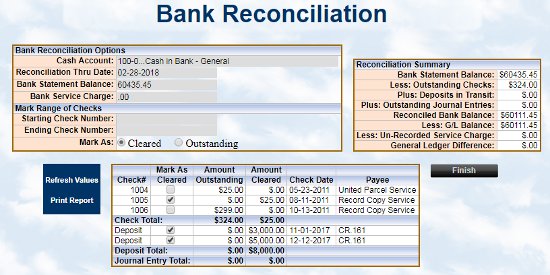

Within the LAWS/Pro "Bank Reconciliation" program set the "Thru Date" as the last day within the current month.

LAWS/Pro will retain this date which will eliminate the need to continually change it throughout the month.

Enter the current bank balance as the "Bank Statement Balance" within the LAWS/Pro Reconciliation.

If there is a service charge noted on within the online bank activity, record it as the "Bank Service Charge" within the LAWS/Pro Reconciliation.

Next, review all the transactions posted online since the last time you reviewed the statement. Mark the processed checks,

and electronic payments or transfers, as "Cleared" within the LAWS/Pro reconciliation. If an on-line entry is missing within LAWS/Pro,

add it as a new disbursement.

Verify that the recent deposits processed through LAWS/Pro match the deposits recorded by the bank. Enter

missing deposits into LAWS/Pro. Sometimes credit card receipts are processed in LAWS/Pro, but aren't recorded at the bank

till several days later. If this occurs, uncheck the missing credit card deposits as "Cleared" until they appear within the

online banking system.

After completing these procedures, the LAWS/Pro cash balance should agree with the firm's online bank account balance.

The reconciled difference will be zero. DO NOT "FINISH" THE RECONCILIATION TILL MONTH END. Doing so will remove all the cleared activity.

This should be done at the completion of the month -- after printing the reconciliation report.

It's very easy to reconcile LAWS/Pro's cash balance to the bank on a daily basis -- taking only a couple of minutes of time.

Discrepancies will be fresh in mind making correction easy.

Try it.